Real estate sale tax calculator

Taxpayers engaged in the real estate business shall refer collectively to real estate dealers real estate developers andor real estate lessors. Offer period March 1 25 2018 at participating offices only.

The Property Tax Equation

This is a simplified version of finding your capital gains tax burden but the basics are.

. Real Estate Transfer Tax Calculator. Prompt easily accessible and very much an expert in the field. Answer a simple question or complete an alternate activity to dismiss the survey box.

Since 2013 the IRS estate tax exemption indexes for inflation. 0 22429 22429. Our real estate commission calculator helps you quickly estimate how much youll pay in real estate commission and what your net home sale proceeds will be.

May not be combined with other offers. Here are 5 ways to find real estate comps in your area. And market a home for sale.

Check out Redfins home sale calculator to see what. To qualify tax return must be paid for and filed during this period. 312 346-5297 Tap Here to Call Us.

You can meet the ownership and use tests during different 2-year periods. View home values schools neighborhoods Texas real estate agents apartments and more. Magicbricks is a full stack service provider for all real estate needs with 15 services including home loans pay rent packers and movers legal assistance property valuation and expert advice.

For tax year 2017 the estate tax exemption was 549 million for an individual or. Predominant use calculator xls The Real Estate Exise Tax Controlling Interest Transfer 36-Month Lookback Period ETA 32162019. The houses street address should allow you access to property tax information that will show the last sold price and the current taxes.

Capital Gains Tax on Sale of Property. As the largest platform for buyers and sellers of property to connect in a transparent manner Magicbricks has an active base of over 15 lakh. Common examples include gains from the sale of stocks mutual funds and real estate.

4 Act 134 of. The fee shall not apply to a deed if a real. Real estate comps can make or break a deal by listing your home at the wrong price point.

Individual Income Tax Return using the listed schedules and forms. The Real Estate Conveyance Tax in Connecticut are paid to the town clerk prior to recording and the the payment is reflected on the deed. Real estate excise tax REET is a tax on the sale of real property.

The Estate Tax Exemption. Used your home as your main home for a period aggregating at least two years out of the five years prior to its date of sale. 2022 real estate capital gains calculator gives you a fast estimate of the capital gains tax.

We can assist you with buying or selling a Condo House or Commercial Property. We can assist you with buying or selling a home. Read more at STATE REAL ESTATE TRANSFER TAX ACT - MCL 207525 Sec.

Commercial real estate loans also come with shorter repayment terms than residential loans. Sale Amount Exemptions Non-Exempt New Constr. Due to these shorter loan terms there are also stiffer penalties in place for early payment on commercial real estate loans to protect the lenders final take.

Use CENTURY 21 to find real estate property listings houses for sale real estate agents and a mortgage calculator. Capital Loss The difference of selling a property at a price lower than the purchase price. This provision is intended to prevent the avoidance of the new transfer tax by the sale of a company owning Class 4A property rather than a sale of the property itself.

It took a big jump because of the new tax plan that President Trump signed in December 2017. Very knowledge and was a true expert when it came to handling the sale of real-estate. Contact Law Office of James Kottaras.

That translates to 1000015000 in real estate commission per agent on a 500000 home sale. The Real Estate Conveyance tax in Connecticut is a 2 part tax- one part is a Municipal transfer tax and the other part is the a State transfer tax. If you have sold real estate property you will have to report any capital gains or losses on Schedule 3 the capital gains and losses form.

Magicbricks is a full stack service provider for all real estate needs with 15 services including home loans pay rent packers and movers legal assistance property valuation and expert advice. A negotiable range of 5 to 20 years is the norm as opposed to a 30-year home mortgage. The information from the Form 1099-S is reported differently depending on the purpose of the transaction will be counted as taxable income.

5 Act 330 of 1993 - State The county tax is calculated in the same method but at a rate of 55 cents per 500. As the largest platform for buyers and sellers of property to connect in a transparent manner Magicbricks has an active base of over 15 lakh. Find 203201 Texas real estate homes for sale and rent.

Best Tax Software Best Tax Software For The Self-Employed 2021-2022 Tax Brackets Tax Calculator Cryptocurrency Tax Calculator Capital Gains Tax Calculator Credit Score. 2021-2022 Tax Brackets Tax Calculator. Use CENTURY 21 Thailand to find real estate property listings houses for sale real estate agents.

The VAT taxpayer in this case is a person who is engaged in the real estate business and is the seller of a real property classified as an ordinary asset. The calculator computes both for 2022 and 2021. What is the real estate excise tax.

If the sale is a sale of property on the installment plan ie payments in the year of sale do not exceed twenty five percent 25 of the selling price the tax shall be deducted and withheld by the buyer from every installment which tax shall be based on the ratio of actual collection of the consideration against the agreed consideration. Capital Gain Tax A tax on capital gains which is the profit realized on the sale of a non-inventory asset that was purchased at an amount that was lower than the amount realized on the sale. Real estate property includes residential properties vacant land rental property farm property and commercial land and buildings.

Finding the right real estate agent is vital to getting the best deal you can whether youre buying or selling a home. Assuming that youre single you would calculate capital gains taxes on this sale as follows. A rate up to 75 cents per 500 is allowed if the countys population is more than 2 million Read more at REAL ESTATE TRANSFER TAX - MCL 207504 Sec.

Transfer Tax Calculator - Chicago Real Estate Lawyer. The real estate transfer tax rate in Connecticut for. The sale of real estate that held for the following purposes are reported on your Form 1040 US.

190000 40401 149599. All sales of real property in the state are subject to REET unless a specific exemption is claimed. Long-term capital gains are taxed at a much lower rate then normal income and short-term capital gains.

Law Office of James Kottaras Home. If a real estate agent represents both the buyer and the seller of the home theyd. This free tax calculator is supported by Google Consumer Surveys.

Valid receipt for 2016 tax preparation fees from a tax preparer other than HR Block must be presented prior to completion of initial tax office interview.

2022 Real Estate Capital Gains Calculator Internal Revenue Code Simplified

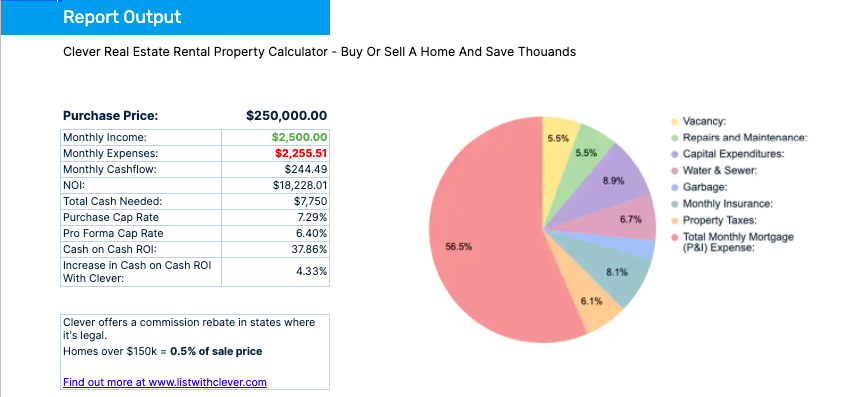

Rental Property Profit Calculator Watch Quick Video Mortgageblog Com

Canada Capital Gains Tax Calculator 2022 Real Estate Stocks Wowa Ca

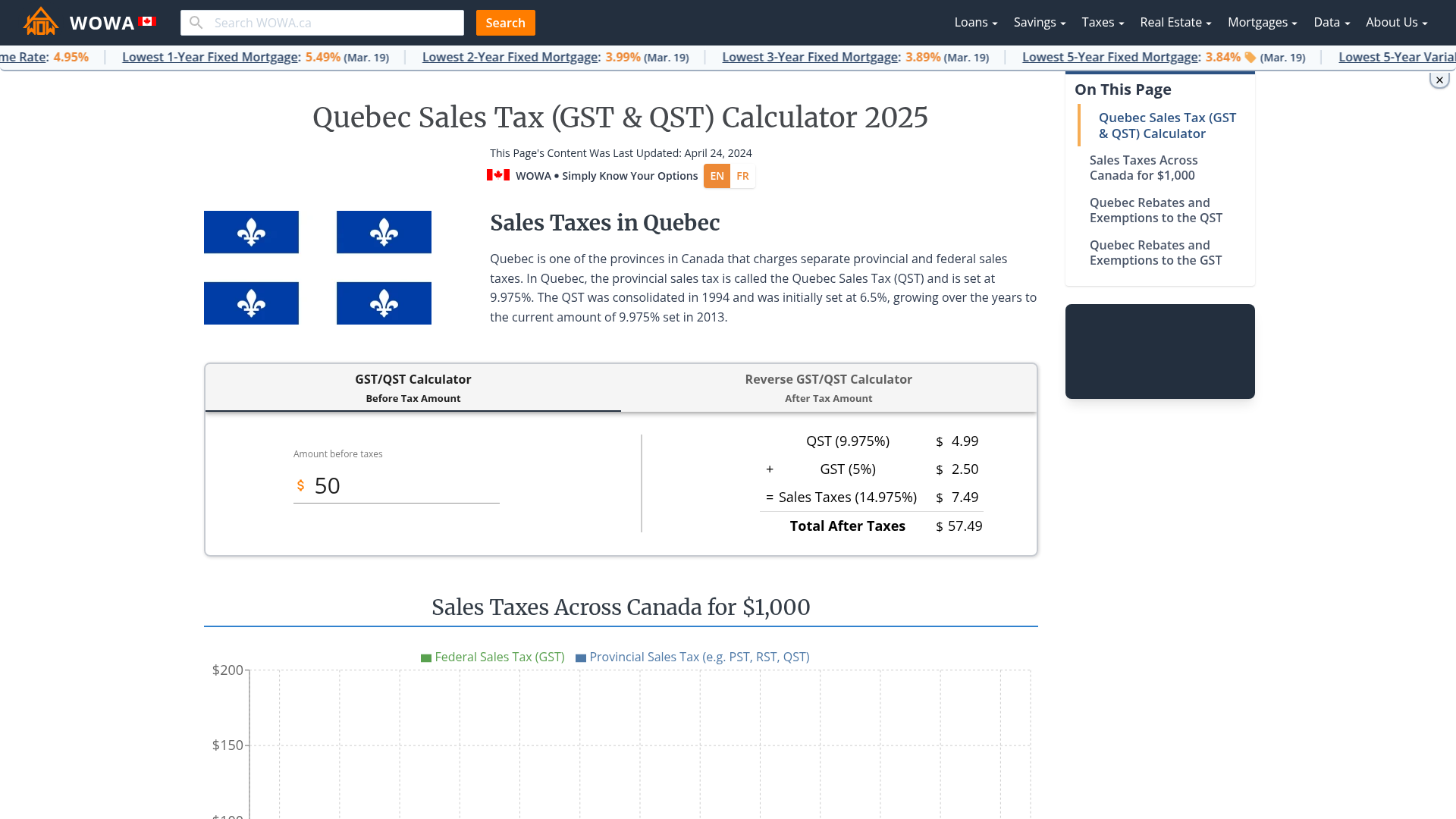

Quebec Sales Tax Gst Qst Calculator 2022 Wowa Ca

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

Canada Capital Gains Tax Calculator 2022 Real Estate Stocks Wowa Ca

Property Tax How To Calculate Local Considerations

Bc Sales Tax Gst Pst Calculator 2022 Wowa Ca

Property Tax Calculator

Home Sale Exclusion H R Block

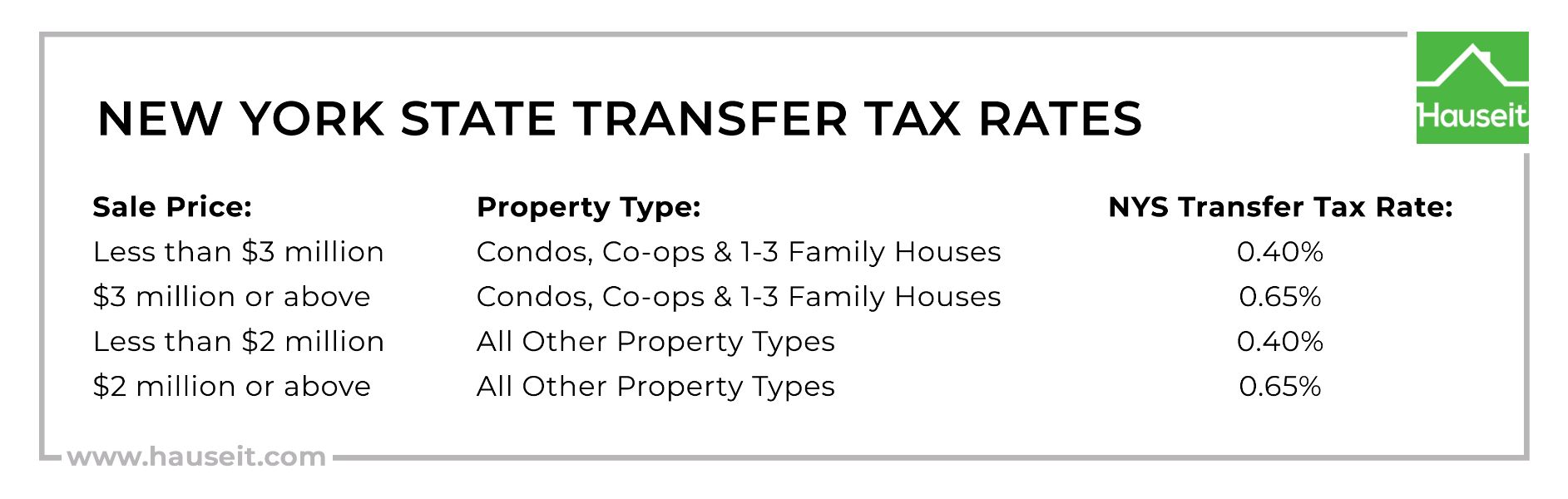

Nyc Nys Transfer Tax Calculator For Sellers Hauseit

Canada Capital Gains Tax Calculator 2022

New Home Hst Rebate Calculator Ontario

Canada Capital Gains Tax Calculator 2022 Real Estate Stocks Wowa Ca

Rental Property Calculator Most Accurate Forecast

Nyc Nys Transfer Tax Calculator For Sellers Hauseit

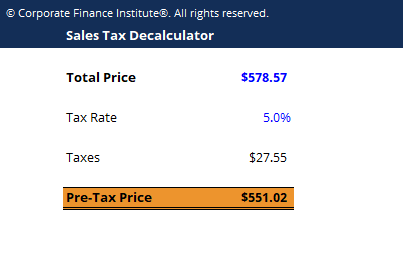

Sales Tax Decalculator Formula To Get Pre Tax Price From Total Price